If your kids have been begging you for money and you need a little extra help running the family business, it may be beneficial to the whole family to start putting them to work after school or during the summer. Given the right situation, you can execute a considerable tax-saving strategy for everyone involved. Here’s what you and your kids can do.

Once you’ve found simple tasks for your children to perform, keeping in mind that it must be a real job pertaining to the business, you can start pushing some of your highly taxed income onto your children at a much lower tax rate. For starters, the income earned by your children will be tax free until the amount surpasses the standard deduction. For 2017, a child could earn up to $6,300 tax free, which would have otherwise been taxed at the owner’s rate. Even if your child earns more than the standard deduction, the starting tax rate will only be 10%. Any amount you can rationally pay your child for work will instantly create tax savings.

If you want to earn even more income tax free and create more benefits for your child, he/she can make an annual contribution of $5,500, limited to the amount of earned income for the year, to a Roth IRA. If your child wants to keep their spending money, parents can contribute part or all of this amount themselves. This is not only an excellent tax strategy but a great way to start college or retirement savings for your children.

Another benefit, but something to be mindful of, is sole proprietorships or partnerships owned wholly by the child’s parents are exempt from paying FICA taxes for children under the age of 18 and FUTA taxes for children under the age of 21. This benefit does not apply if the family business is incorporated or is a partnership that includes a non-parent of the child. It is important to know when these exemptions do and don’t apply to your children. In all circumstances, you must file a Form W-2 to the IRS for any income earned by your child.

If your child attends or is about to attend college, he/she may also be able to utilize education credits which would have otherwise been phased out in your own income bracket. If your child earns enough income to file an independent tax return, the American Opportunity Credit or Lifetime Learning Credit can be applied to further reduce the tax liability. It is also important to remember in this situation that any income your child receives can negatively affect potential financial aid or scholarships. In these situations, you need to determine which strategy creates the most savings.

In addition to the benefits and potential issues discussed above, you must also remember child labor laws still apply when employing children in the family business. These laws will vary from state to state. Your child must earn reasonable compensation for his/her job, and you may have to justify any wages paid to the IRS in the event of an audit. As a reminder, paying your child a reasonable amount for work performed in the family business can create a great deduction for your income taxes, but pushing all of the income from your business onto your child for doing family chores can create a big problem.

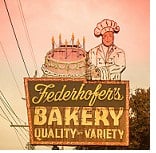

Photo by Thomas Hawk (License)